Contact Us: (914) 664-1900

Running an ecommerce business is exciting, but sales tax compliance? Not so much. With constantly changing tax laws, varying state requirements, and the complexities of marketplace nexus, staying on top of your sales tax obligations can feel overwhelming. That’s where we come in. At eBiz Accounting, we specialize in sales tax solutions for ecommerce business owners like you—sellers operating on Amazon, Shopify, Alibaba, TikTok, WooCommerce, or Walmart Marketplace. Whether you’re a seasoned seller or just starting out, our expertise ensures that your business remains compliant, audit-ready, and free from costly penalties.

Sales Tax is Complex. We Make It Simple.

Ecommerce sales tax isn’t just about collecting the right amount—it’s about knowing where you’re required to collect, when to file, and how to navigate evolving regulations across multiple states. With online sales expanding across marketplaces, your tax obligations grow too. You need a partner who understands ecommerce inside and out.

At eBiz Accounting, our sales tax services are designed to take the burden off your shoulders. We handle everything from registration to reporting, ensuring accuracy and compliance every step of the way.

Our Comprehensive eCommerce Sales Tax Services

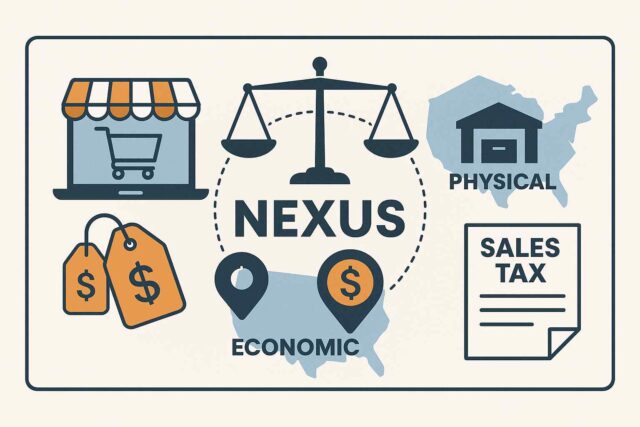

Sales Tax Nexus Analysis

Not sure where your business has a tax obligation? We’ll conduct a thorough nexus analysis to determine which states require you to collect and remit sales tax. Many sellers don’t realize that economic nexus laws have changed the game—meaning you might be responsible for collecting tax in states where you don’t have a physical presence. We help you identify your obligations before they become a problem.

Sales Tax Registration

Once we determine where you have nexus, we’ll handle the entire registration process for you. Each state has its own requirements, forms, and fees, and navigating them can be time-consuming. We ensure your business is properly registered in every jurisdiction necessary so you can focus on selling.

Sales Tax Calculation & Collection Setup

Charging the correct sales tax rate is critical. Whether you sell on Amazon FBA, Shopify, WooCommerce, Walmart, Alibaba, or TikTok Shop, we help you set up tax collection correctly within your marketplace or ecommerce platform. Our team ensures that your sales tax rates align with state requirements, keeping your business compliant.

Sales Tax Filings & Remittance

Sales tax reporting isn’t just about knowing how much to collect—it’s also about knowing when and where to file. We take care of:

- Preparing and submitting sales tax returns

- Filing with the correct state agencies

- Remitting payments on your behalf

- Keeping track of deadlines to prevent late fees

With eBiz Accounting managing your filings, you can avoid penalties and ensure accurate reporting every time.

Audit Protection & Compliance Support

If your business is ever audited, we’ve got your back. Our team provides audit support, documentation preparation, and expert guidance to ensure you’re prepared. We also offer ongoing compliance monitoring, so if tax laws change, your business stays ahead of the curve.

Contact eBiz Accounting

Sales tax doesn’t have to be a headache. With eBiz Accounting on your side, you’ll have a trusted partner to handle everything—from nexus determination to tax filings—so you can stay compliant and stress-free.

Ready to simplify your sales tax obligations? Contact us today for a consultation and let’s take sales tax off your plate for good.

© 2025 eBiz Accounting. All rights reserved. Attorney advertising.