Contact Us: (914) 664-1900

-

How We Can Assist in Filing Your Business’s Tax Returns?

Please read this & contact Ebiz Accounting to discover how we can help you file your Amazon business's taxes. -

How Frequently Should I File Sales Tax Returns for My Ecommerce Business?

Wondering how often you should file sales tax returns for your ecommerce business? Read this blog and contact our team to learn more. -

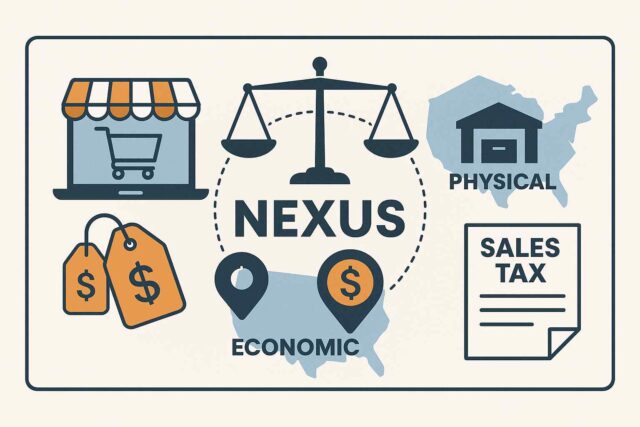

Do I Need to Collect Sales Tax for Online Sales? Understanding Nexus

If you're an online seller, you may wonder if you'll have to collect sales tax nexus. Read this blog and contact our team. -

What Are the Benefits of Amazon’s Automate Pricing Tool?

Please read this & contact our firm to learn how sellers can benefit from utilizing Amazon's Automate Pricing tool. -

How to Report an IP Violation to Amazon?

Please read this to learn about intellectual property, what IP violations Amazon enforces, and how to report suspected infringement. -

What Are the Benefits of Securing a Trademark?

Read this & contact our firm to inquire further regarding the advantages of obtaining a registered trademark for your brand on Amazon. -

How to Use Business Certifications to Stand Out as an Amazon Seller?

Business certifications can enhance visibility, build customer confidence, and unlock new market opportunities. Read on to learn more. -

How to Find Wholesalers for Your E-Commerce Business?

Amazon sellers are allowed to work with wholesalers. Please read this to learn how wholesalers can support your e-commerce business. -

Amazon’s Dangerous Goods Classification Process: What You Need to Know?

If you're an Amazon FBA seller, please read this & contact our team today as we explore the dangerous goods classification process. -

How Can Amazon Sellers Prepare for the Holiday Season?

To boost sales, you should be proactive and properly prepare for the holiday season. Please read on to learn more.

© 2025 eBiz Accounting. All rights reserved. Attorney advertising.